The silence of a closed University of Texas San Antonio (UTSA) Downtown Campus stands in stark contrast to the hundreds of clients that have been seeking assistance and relief since the COVID-19 pandemic resulted in the temporary closing of so many of San Antonio’s small businesses. According to the U.S. Small Business Administration (SBA), over half of Americans either own or work for a small business, and small businesses are responsible for two-thirds of new jobs each year. Located in the Durango Building of the Downtown Campus is the UTSA Small Business Development Center (SBDC), a resource that small businesses are relying on now more than ever, for a light through the current crisis.

Background on the Center

The UTSA SBDC is comprised of certified business advisors, a training team, administrative staff and has been assisting small business owners and entrepreneurs in South Texas since 1989. They offer integrated services to meet the needs of small businesses, including no-cost, confidential, one-on-one advising and low to no-cost training workshops. They have consistently been recognized as a leading center of a larger network comprised of 10 service centers that serve a 79-county region in South Texas in partnership with the SBA.

In 2019, UTSA SBDC assisted in the creation of 96 new businesses, 841 jobs, and a total capital formation of $37,434,978. Of the clients who utilize national small business development centers, 60% go on to start a business within their first year proving that small business ownership is vital to the Texas economy, and the need for resources like UTSA SBDC is only growing greater.

Responding to COVID-19

Over the past few months, almost every small business has been impacted by the COVID-19 pandemic. They have been faced with gut-wrenching decisions regarding their employees, adapting their business model to stay open, or facing the harsh reality of closing. On March 27 President Trump signed into law the CARES act, making $376 billion available to families and small businesses. Relief for small business owners was conducted via the Paycheck Protection Program (PPP), Economic Injury Disaster Loan (EIDL) Emergency Advance, Express Bridge Loans, and through current loan forgiveness or extending payment deadlines. The process to receive any of these funds required a series of complex applications, leaving many owners wondering which form of relief would be best for them and what to do next. Some owners questioned if they even qualified.

“When the U.S. Small Business Administration released the available funding options, we were inundated with calls, both from long-term clients and customers who were contacting us for the first time,” says UTSA SBDC Director Richard Sifuentes. “Our team handled over 350 individual inquiries in the first week alone, and our advisors were able to help each one find the best option and how to begin the process.”

Between late March and the end of May, UTSA SBDC’s team spent over 1,200 hours dedicated specifically to assisting with COVID-19-related relief funding requests, while still servicing their non-COVID-related clients.

In a national Coronavirus Impact study conducted by America’s SBDC and Thryv Inc., 63% of small business owners surveyed across the country had already applied for SBA assistance. 9% said they are likely to still attempt applying and 26% said they are unlikely to apply. By May 10, 66% of businesses surveyed had already received requested funding.

Once the funding applications were submitted, small businesses were faced with another challenge: when and how to reopen safely. Besides relying on guidance from the Center for Disease Control, regulations depend largely on which county the business is located in. In May, Governor Abbott laid out a phased reopening that included restaurants first, followed shortly by salons, spas, gyms, etc. While certain small businesses have been allowed to reopen, the largest hurdle has been creating a sense of comfort for customers so they feel safe purchasing services or products in person again. UTSA SBDC advisors have continued assisting small businesses with marketing and planning to create an environment of safety and calm, while also fulfilling reopening guidelines and helping to interpret the terms of disaster funding.

Helpful Programs

In April 2020, the UTSA Institute for Economic Development, of which UTSA SBDC is a part, launched the Small Business Development Center COVID-19 Business Recovery Accelerator (SBDC COBRA). The Accelerator was created through funding from the SBA and serves as a landing pad for impacted small businesses, augmenting UTSA SBDC’s efforts. As of August, the UTSA SBDC & the SBDC COBRA have jointly assisted over 6,200 individual inquiries.

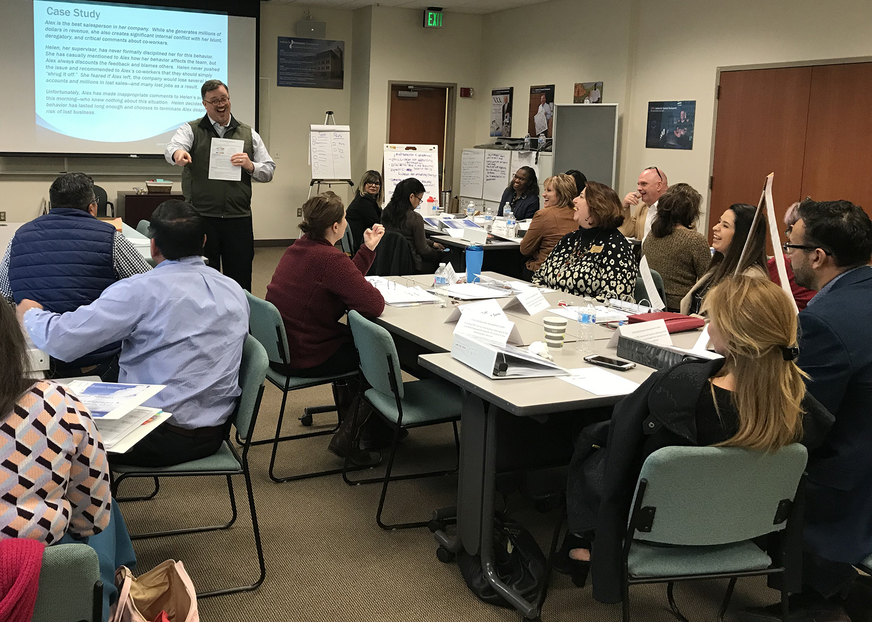

Yet another service provided by the UTSA SBDC is low- to no-cost training workshops. Under the direction of Training Coordinator, Mariah Kilbourne, the UTSA SBDC holds over 200 workshops per year. Instructors are made up of advisors on staff, as well as knowledgeable external speakers who volunteer their time. Typically, a workshop would meet in person at the UTSA Downtown Campus and count an average attendance of 20 registrants. In order to meet the new demand for online training, Kilbourne created a training schedule of webinars, which has been able to accommodate many more attendees overall. It seems that this may be the continuing protocol even after the UTSA campus reopens later this summer.

In the meantime, UTSA SBDC strives daily to assist small business owners and entrepreneurs in starting and growing Texas businesses, resulting in job creation, economic diversification and business expansion. With access to the most recent government and research resources, UTSA SBDC continues to help the lifeline of Texas small businesses thrive. If you’d like to learn more about the UTSA SBDC’s services or schedule an appointment for advising you may contact them by phone at (210) 458-2460 or visit them online at SASBDC.org. If you’d like to contact the UTSA SBDC COBRA, you may reach them at (210) 458-2272 or visit them at txsbdc.org/businessrecovery.

About the SEDC

The City of Schertz Economic Development Corporation’s (SEDC) mission is to grow the Schertz economy through projects that focus on job creation and retention, as well as infrastructure improvements. To further this mission, the SEDC focuses on attracting and retaining primary job employers – companies that produce exportable goods and services. Assisting with workforce development and helping connect business with business support opportunities is one example of how the SEDC continues to provide support through its Business Retention and Expansion program to companies after they locate in the community. For more information on the SEDC and its initiatives, click here.