Quarterly Report Overview

Every quarter, the Schertz Economic Development Corporation produces a Quarterly Report, highlighting the Schertz real estate market and ongoing Projects. Be sure to follow us on Twitter to stay up-to-date on Schertz economic development.

Our latest Quarterly Report includes an analysis of the Schertz and San Antonio real estate landscape (focusing on the industrial sector), details on notable Projects, a development update that maps out current development across the city, and a breakdown of available Class A industrial properties and development ready sites.

Executive Summary

Highlights from the report include: Nexus, a health care and insurance clinical review company, is relocating their headquarters to Schertz. Their new facility, located at 5600 Schertz Parkway, will consist of 36,450 square feet. Construction is scheduled to begin August 2019. The Schertz 125 & Lookout Road Intersection project – which will provide an additional access point to Enterprise Buildings 3, 4, and 5 from Lookout Road – has an estimated completion date of September 2019. The bridge is in place and roadway construction is nearing completion.

Schertz’ Industrial Average Asking Price has stayed flat for the previous two quarters, hovering around $5.49 per square foot per year. Overall, the Average Asking Price is 7.6% lower when viewed year over year ($5.48 versus $5.93). Regarding the Real Estate section of the report: previous quarterly data – ranging from average asking price to notable leasing activity – was provided by CoStar. Beginning in April 2019, the SEDC began internally tracking Schertz’ industrial inventory. Historical data (April 2017-March 2019) is provided by CoStar and can be seen in this report.

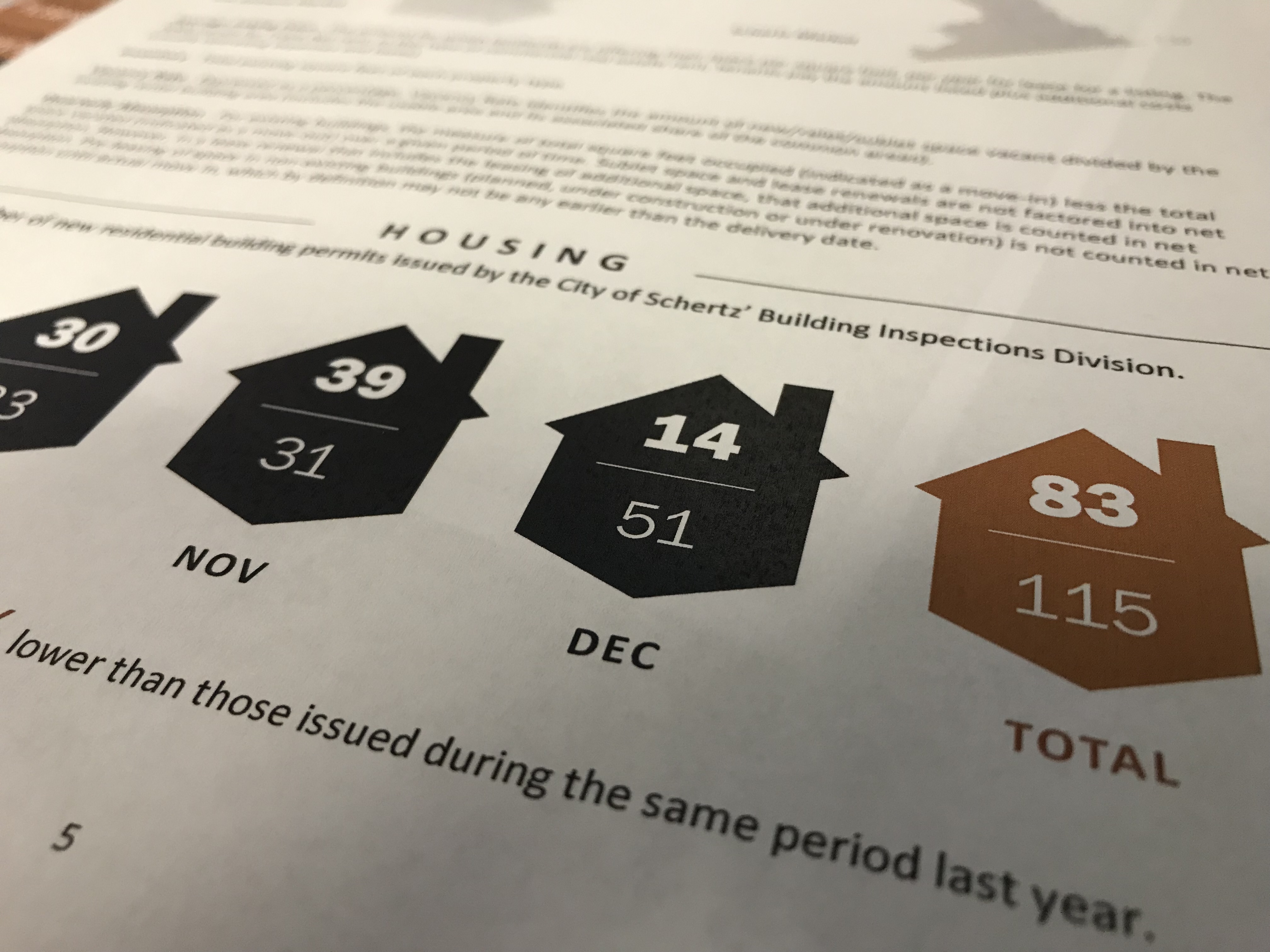

During the quarter, approximately 302,000 square feet of industrial commercial space was occupied/leased across 4 buildings. Additionally, approximately 640,700 square feet of space – consisting of 4 buildings – is currently under development review. The number of new residential building permits issued during the quarter was down 60.7% from the same period last year.